Pelajari bagaimana para pemimpin menghadapi kompleksitas di cloud

Temukan wawasan dari lebih dari 1.100 pemimpin TI global tentang tantangan kompleksitas cloud dan strategi yang mendorong kesuksesan.

Inovasi terhambat seiring pertumbuhan semakin kompleks

Infrastruktur modern mencakup berbagai alat, penyedia cloud, dan lingkungan. Kompleksitas ini menahan potensi cloud untuk mendorong inovasi dalam skala besar.

- 52% organisasi

melaporkan bahwa kompleksitas cloud merupakan tantangan utama

- 42%

mengatakan kurangnya visibilitas membuat pengelolaan infrastruktur cloud menjadi lebih sulit

- Lebih dari 5 alat dan layanan

digunakan rata-rata untuk mengelola lingkungan cloud

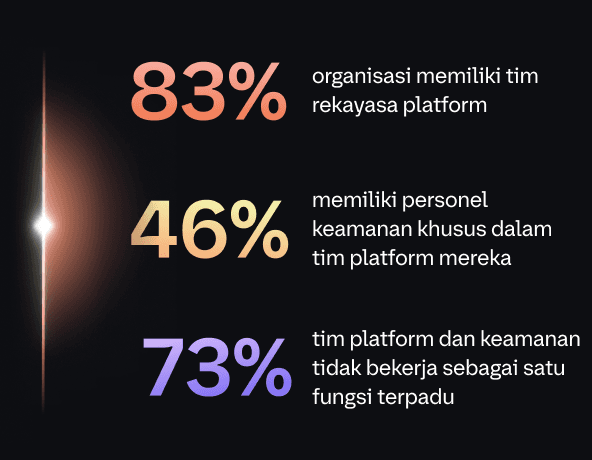

Ketidakselarasan tim meningkatkan risiko

Tim keamanan dan platform harus berkolaborasi lebih erat untuk mengurangi risiko. Para pemimpin sepakat: keamanan harus tertanam di sepanjang siklus hidup infrastruktur.

Platform terpadu menyederhanakan operasi

Organisasi terkemuka berinvestasi dalam platform manajemen siklus hidup terpadu untuk menyederhanakan operasi, mengurangi risiko, dan mempercepat inovasi.

51%

melaporkan peningkatan visibilitas dan pemantauan

37%

melihat pengurangan biaya dari konsolidasi alat

51%

melaporkan kolaborasi tim yang lebih kuat

Unduh The 2025 Cloud Complexity Report

Pelajari bagaimana organisasi teratas mengatasi kompleksitas cloud — dan apa yang bisa Anda lakukan untuk tetap unggul.