The third annual HashiCorp State of Cloud Strategy Survey reveals the continued evolution of enterprise cloud strategy among companies in the financial services industry. The 2021 survey welcomed enterprises to the multi-cloud era, demonstrating the prevalence of a common multi-cloud operating model. The 2022 results reiterated those findings and underscored how a multi-cloud approach is delivering meaningful business value.

For 2023, we once again commissioned Forrester Consulting to conduct the survey. In addition, we worked with Forrester to develop a cloud maturity model for describing where organizations are in their cloud adoption journey. And we were able to break out the overall results for key industries, including financial services/insurance.

You can see the results of the global survey, learn more about the maturity model, and access the full Forrester Consulting study at https://www.hashicorp.com/state-of-the-cloud, but this blog post shares key results specifically for the 134 respondents in the financial services and insurance industries (out of a total sample size of 963, drawn from a variety of industries around the world).

The results were clear: Almost 9 out of 10 financial services respondents are seeing business and technological benefits from their multi-cloud approach, including everything from boosting reliability to improving their ability to deal with ongoing cloud skills shortages. Perhaps that’s why – despite global macroeconomic pressures, more than twice as many financial services orgs are boosting their cloud investment as are cutting cloud spending.

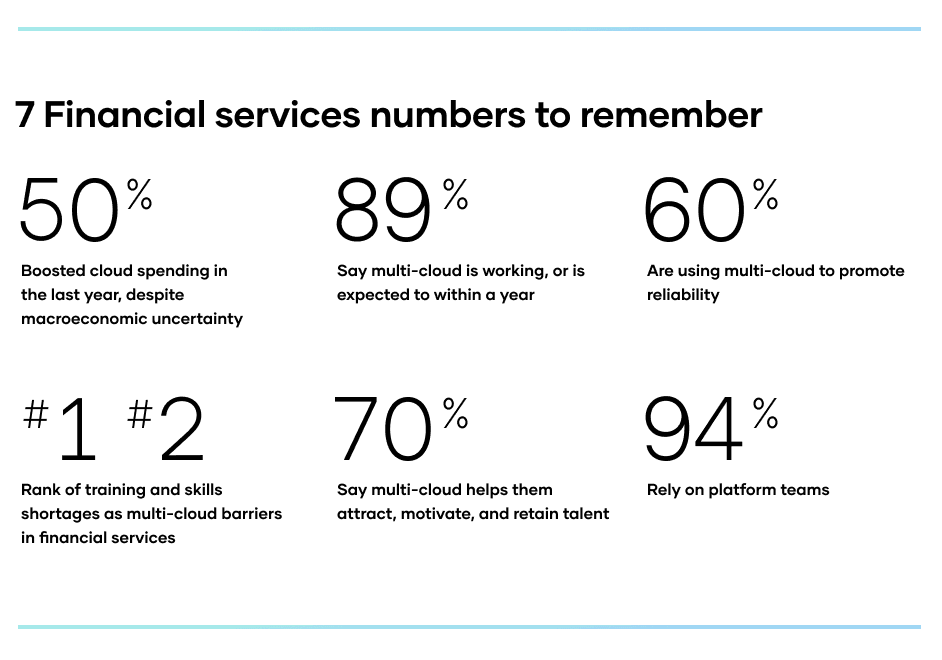

»50% Of financial services respondents boosted their cloud spending

Despite worldwide macroeconomic uncertainty, half of financial services survey respondents actually increased their cloud spending in the last 12 months. Only a quarter (25%) cut their spending. Some of the additional spending is no doubt due to inflation, but even as finserve companies work to improve governance, risk management, and compliance (GRC) to cut waste with individual cloud service providers, the secular trend is so powerful that their overall cloud investments continue to grow.

The macro factors impacting the cloud economy include inflation and rising interest rates, geopolitical uncertainty, and supply chain risk. The result has been a decrease in public cloud valuations that have trickled down to the private markets as well. But our organization has grown and has onboarded new SaaS clients which further result in increasing cloud cost. — Infrastructure Architect at an Asia-Pacific financial services firm

»89% of financial services respondents say multi-cloud works

More than two thirds (70%) of financial services organizations say their multi-cloud strategy has already advanced or achieved their company’s business goals, and another 19% expect it to do so in the next 12 months.

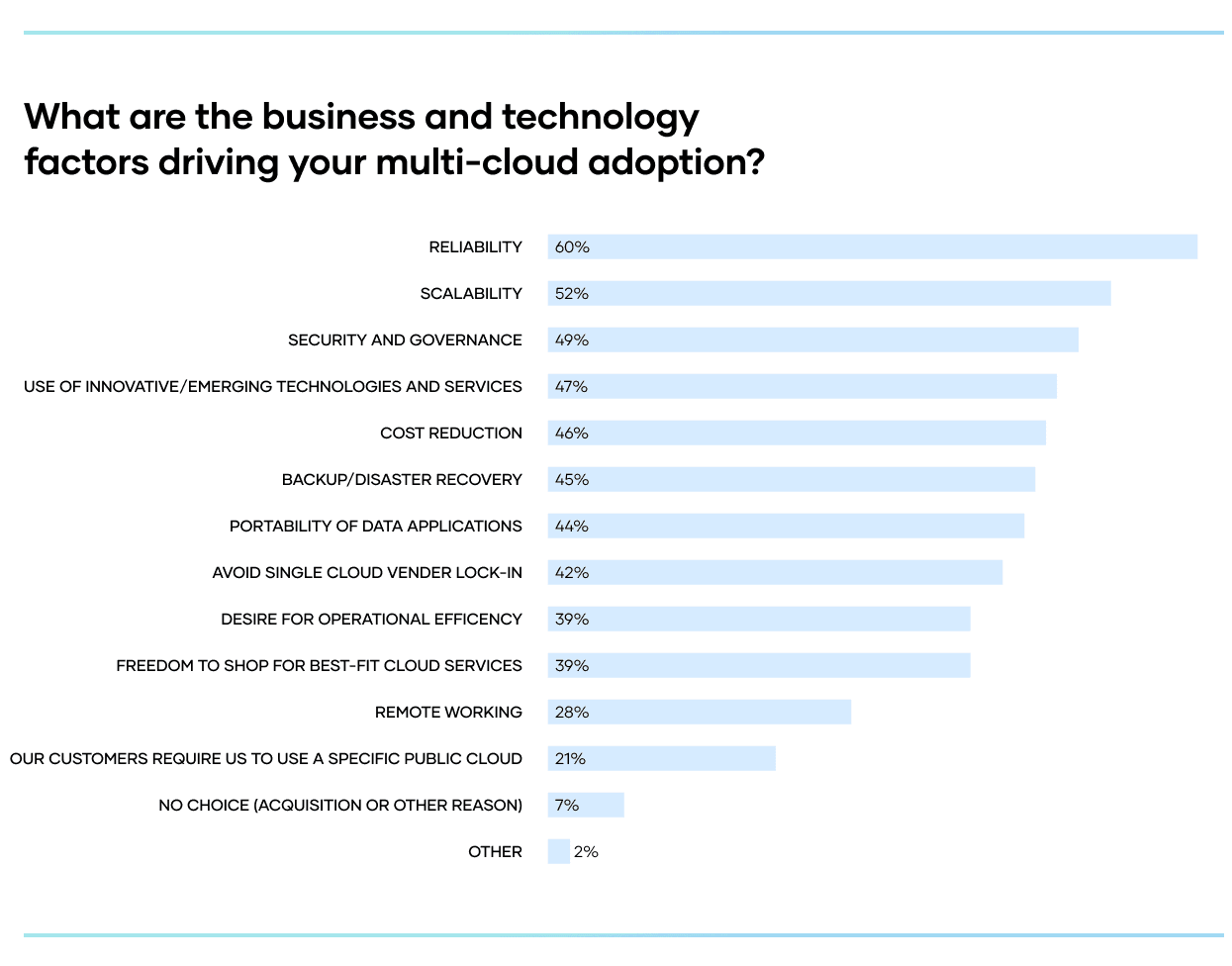

»60% of financial institutions are using multi-cloud to promote reliability

Among financial services respondents, reliability (60%) topped the list of business and technology factors driving multi-cloud adoption, followed by scalability (52%) and security & governance (49%). Digital transformation (47%) and use of innovative/emerging technologies and services (47%) were tied for fifth place. Overall respondents, meanwhile, cited reliability (51%), cost reduction (48%), and digital transformation, scalability, and security & governance (45% each). The big difference: financial services companies were more likely to cite the ability to tap into new tech, while respondents overall were more likely to be driven by the search for cost savings.

»#1 — Rank of compliance and security as multi-cloud success factors in financial services

Meeting regulatory/compliance requirements and security topped the list of multi-cloud success factors for survey respondents in the financial services industry, with 90% of finserve respondents calling them either important or very important. (Compliance edged out security in the “very important” category, 61% to 60%.) Overall respondents ranked security almost as high (87%), but only 81% ranked compliance as important (35%) or very important (46%). The difference makes sense given the heavily regulated nature of the financial services industry.

Finserve respondents also ranked infrastructure scaling (88%), the ability to deliver uptime and availability (88%), visibility/insight into cloud infrastructure (83%), and staffing/skill level (82%), as key multi-cloud success factors. Notably, however, every one of the 12 choices presented were called important or very important by 70% or more of finserve respondents, showing that the industry sees a broad set of multi-cloud benefits.

»#1 and #2 — Rank of training and skills shortages as multi-cloud barriers in financial services

The ongoing shortage of skilled cloud talent is a critical but complex issue for companies across the entire maturity spectrum. So it should be no surprise that training (32%) and skills shortages (31%) were the most commonly named factors complicating finserve companies’ ability to operationalize multi-cloud. Overall, survey respondents most often cited skills shortages (27%) and siloed or inefficiently used infrastructure (26%) as multi-cloud complicating factors.

»70% of financial services companies say multi-cloud helps them attract, motivate, and retain talent

In response to training and skills-shortage barriers noted above, more than two thirds of financial services respondents are finding that their multi-cloud approach is helping them attract, motivate, and retain the talent they need, while, another 14% of finserve respondents expect their multi-cloud strategy to help them with their talent issues in the next year. Those results slightly exceed the overall survey responses, where 68% reported gaining staffing benefits from multi-cloud, and another 16% expect to receive those benefits in the next year.

»94% of financial services organizations rely on platform teams

Centralized platform teams are increasingly ubiquitous as an organizational approach to enable the adoption and operation of cloud. The process is not yet complete, however, as of the 96% of financial services respondents using platform teams in their organization, 17% are adopting them, 33% are standardizing on them, and 46% are scaling platform teams throughout the organization. For comparison, platform team usage among financial services orgs just barely tops survey-wide results, where 17% are adopting them, 36% are standardizing on them, and 39% are scaling them.

Thanks to platform teams we can prepare and unify cloud solutions in our company. We also can improve our security and time to market (and other factors) by re-using patterns and tools. — Infrastructure Architect at a European financial services firm